INDIANAPOLIS — Let's say it's time to make a large purchase and the item costs a few thousand dollars.

The salesperson lets you know there is a promotion available. Zero percent deferred interest for a period of time.

Sounds good, right? Maybe so, maybe not. That is because there is small print that can result in a big price tag.

It is something J.C. Hatton learned the hard way.

"I considered it predatory lending," Hatton said.

A little over a year ago, Hatton bought a $4,000 couch from Macy's.

He signed up for their credit card since they were offering a promotion: 0% deferred interest.

"It's 12 months, same as cash," Hatton explained, "So, if they're not going to give me a discount, then having that liquidity makes sense for that that period of time. "

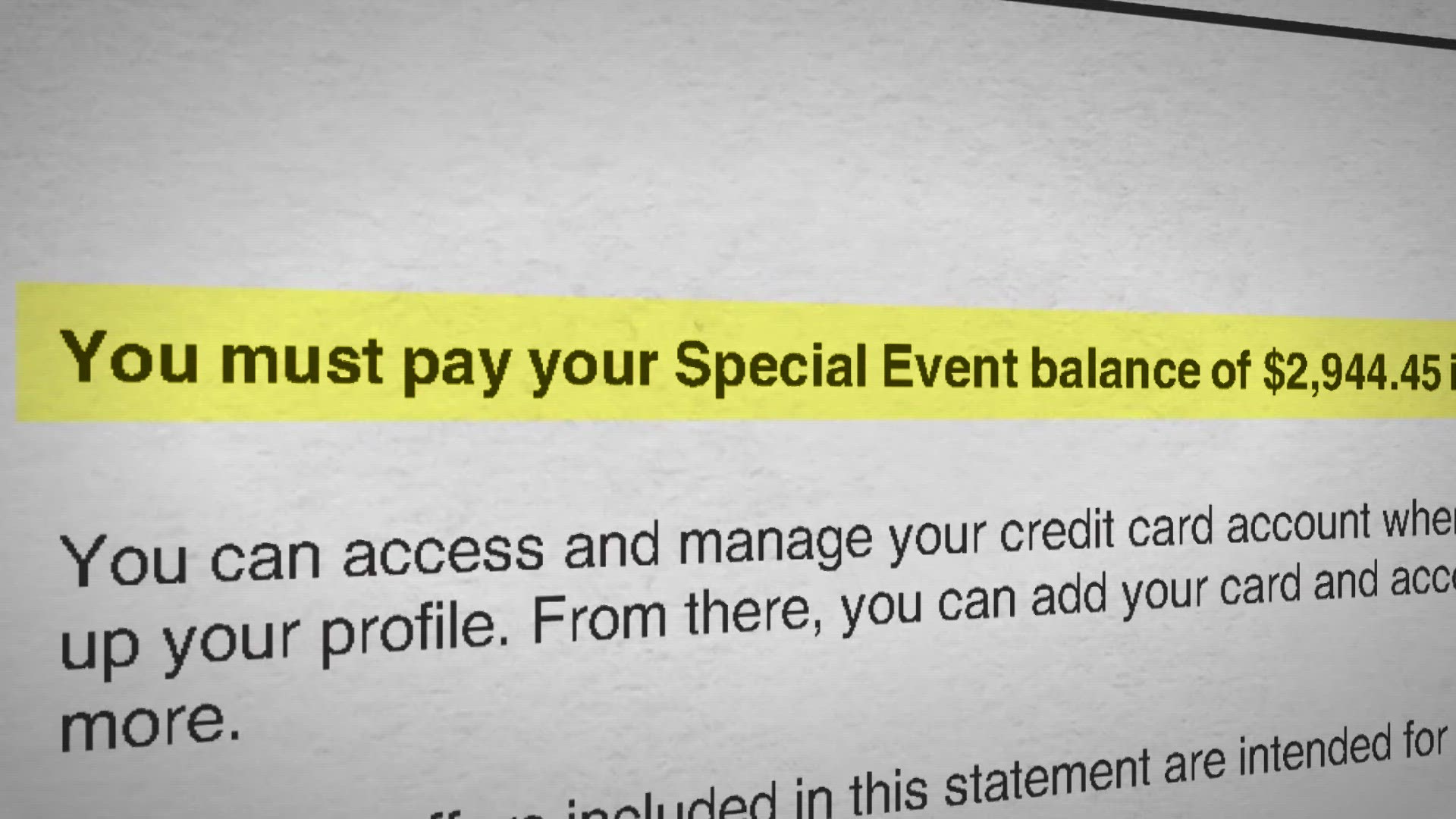

But when the balance came due at the end of the term, the couch was not paid off despite the note on his statement that reads in-part "You must pay your Special Event balance...in full....to avoid paying deferred interest charges."

An oversight, Hatton admits, now in plain sight.

"The deferred interest extra was almost $1,300 for a 12-month span on a couch that was right about $4,000."

The word deferred means delayed.

So deferred interest is delayed interest, but only for a period of time.

If the balance is paid when the calendar strikes due, the deferred interest payment stays at $0, and the customer has saved money on a financing agreement.

But if any portion of the balance is not paid when the calendar strikes due, all of the interest could be owed on the entire loan.

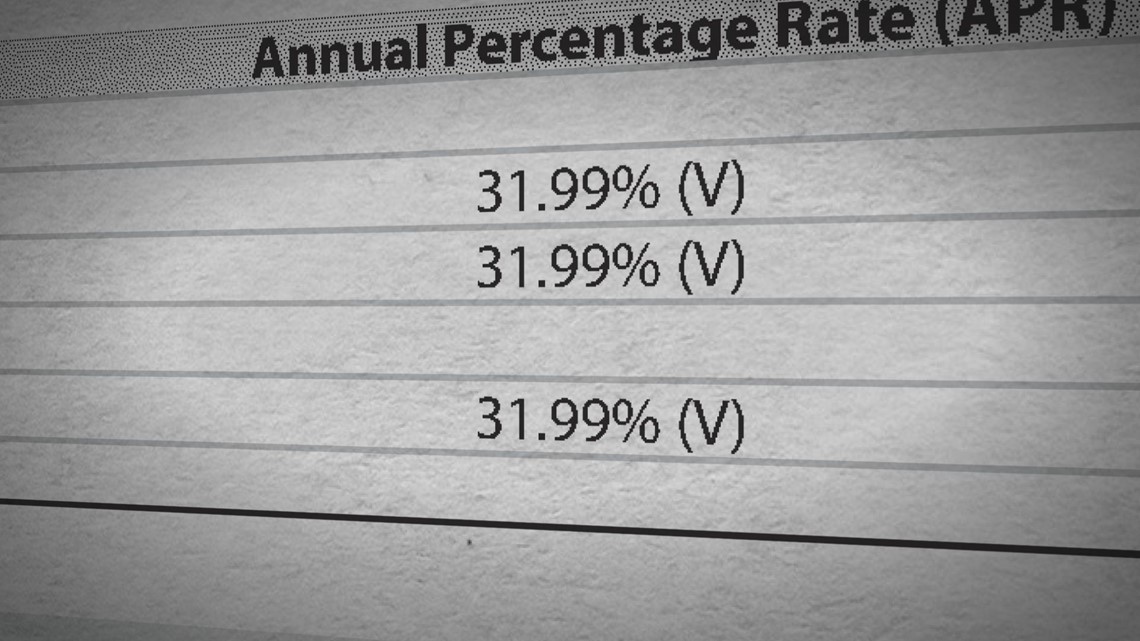

In Hatton's case, the interest rate was 31.99%.

The Consumer Financial Protection Bureau said usually, the interest is calculated based on the balance you owed in each month since you first made the purchase. So, if you don’t pay the entire balance off in 12 months, or if you are more than 60 days late in making a minimum payment, you will be charged interest for each month on the balance you owed in each of the 12 months.

The CFPB added that when considering a promotion, look for the word 'if.'

For example, 'no interest if paid within 12 months.'

Ted Rossman with Bankrate said he sees these types of offers with store credit cards.

"I think it's definitely a 'gotcha' in the sense of a lot of people don't read or understand the fine print. They just hear 0% ," Rossman said.

Those stores are often retailers that offer big ticket items including jewelry, appliances, home improvement jobs and furniture.

"Let's say you make a $5,000 purchase. You pay it all off, except for $1. I mean, it could be as little as $1," Rossman explained "If you haven't paid the full amount, they go back and they charge you retroactively."

If you are currently on a deferred interest plan, it's important to set reminders so you do not miss the final payment.

As for Hatton, he reached out to the Better Business Bureau about the matter.

Macy's said in a letter that although Hatton was properly charged, they would remove the $1,243.77 in interest as a courtesy.

"Obviously, reading through my statement at least once or twice, all the way through, would have saved me from this," Hatton admitted, "but you also don't know what you don't know."

And now, Hatton knows.