INDIANAPOLIS — If your home was damaged by storms, there are a few things you'll want to do before signing on the dotted line with a repair company.

Hiring the right contractor

First, get multiple bids. Use social media and community groups like Nextdoor to see who your neighbors, friends and family have used and trust.

Scott Barnhart, Chief Counsel and Director of Consumer Protection at the Office of the Indiana Attorney General, said referrals are a good place to start.

"And if you get an unsolicited response from a from a contractor, ask them for references, ask them for referrals. You know, if they don't want to give them to you, that's a bad sign," Barnhart said.

Next, background them. Are they local? How many years have they been in business?

Look for reviews on the Better Business Bureau, the company's Facebook page and Google.

When you're ready to sign, map out payments that you're comfortable with. Avoid big upfront deposits. Also ask for a lien waiver. That way you're not stuck paying suppliers if the contractor doesn't.

"Make sure that you're not making the final payments if a subcontractor has not been paid," Barnhart said.

If you signed a deal you don't feel good about, Barnhart says you have three days to cancel.

If you were able to avoid damage this storm, it might be a good idea to start this process now. That way, if something happens, you're prepared.

What about insurance?

The Insurance Information Institute said hail damage to homes is covered under your standard homeowners insurance policy. Typical home damage from a hailstorm would be damaged roofs, damaged siding and torn screens. Flood damage to homes, however, is covered by a flood policy. If you don’t have flood insurance, you most likely are not covered.

If a tree hits an insured structure, the Insurance Information Institute said that a homeowners policy covers the cost of removing the tree, generally up to about $500 to $1,000, depending on the insurer and the type of policy purchased. If the fallen tree did not hit an insured structure, there is generally no coverage for debris removal. However, sometimes insurance companies may help cover the cost of removal if the fallen tree becomes an obstacle for the home’s occupants, like blocking a driveway or doorway.

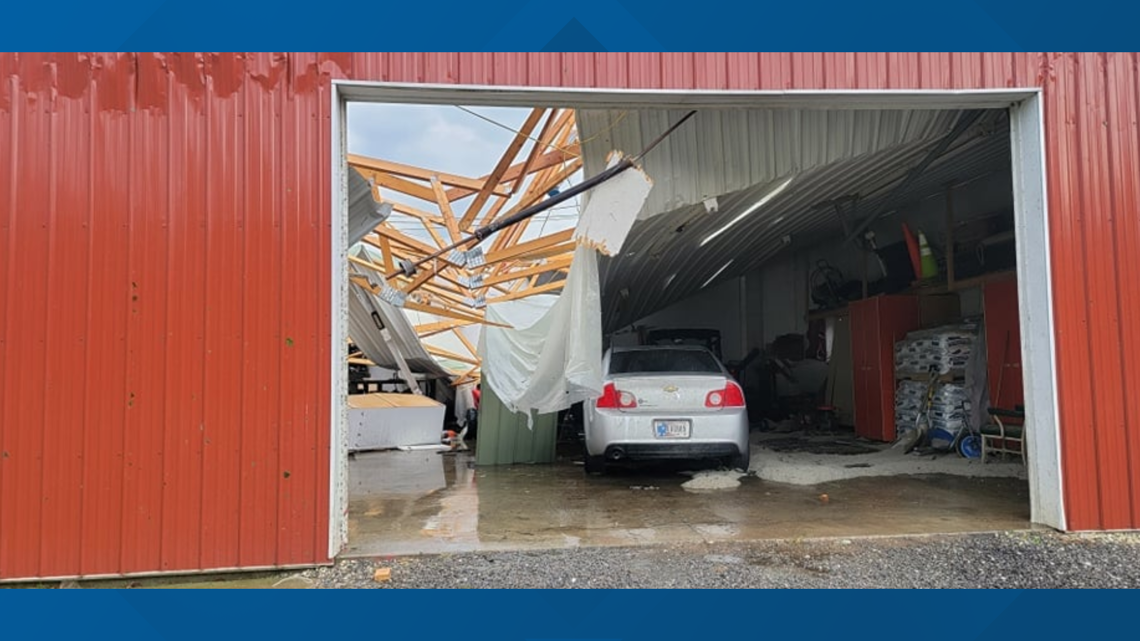

When issues arise, take photos of the damage to help expedite the claim process. Keep receipts for any out-of-pocket expenses you incur for any “emergency repairs” you need to make before the claim adjuster gets to your home to assess the damage and determines a timeline for making repair. Don’t throw anything away that was damaged or destroyed until your insurance adjuster assesses the damage.