INDIANAPOLIS — Indiana Gov. Eric Holcomb has signed a new law to protect Hoosiers against surprise ambulance bills.

State lawmakers passed House Bill 1385 with overwhelming bipartisan support just months after 13 Investigates showed how thousands of Indiana families have been stuck with large ambulance bills that their insurance companies refused to pay.

Now that the governor has signed the bill into law, insurance companies and ambulance providers will be required to settle billing disputes rather than placing the burden on unsuspecting Indiana families.

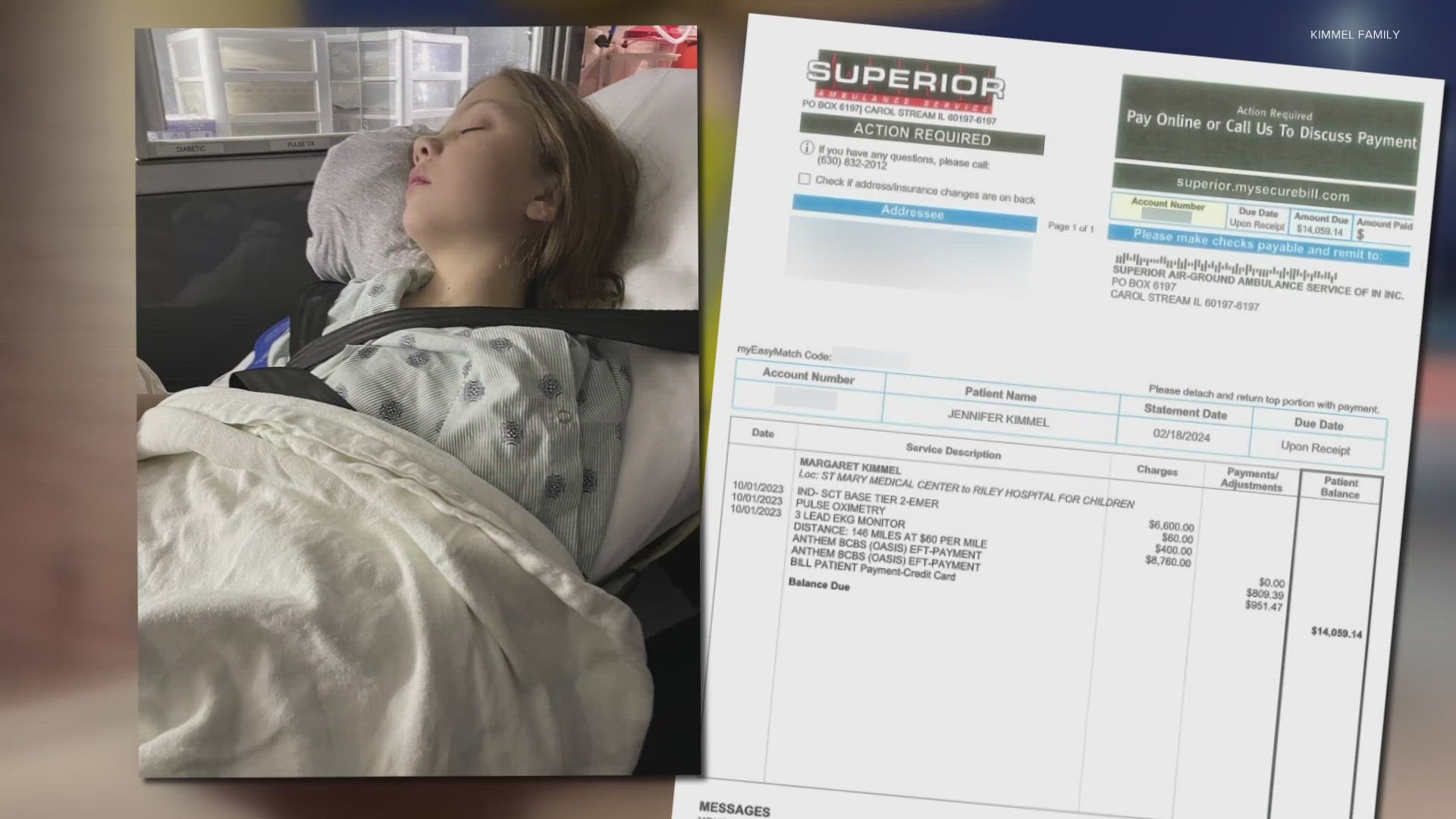

$15,000 surprise bill

The Kimmel family exemplifies why the new surprise billing law is desperately needed.

Nick and Jen Kimmel received an unexpected bill from Superior Ambulance after their 10-year-old daughter, Maggie, needed an ambulance transport from St. Mary Medical Center in Hobart to Riley Hospital for Children in Indianapolis. Charges for the 146-mile transport totaled $15,820.

The Valparaiso couple assumed their insurance company, Anthem Blue Cross and Blue Shield, would cover most of the ambulance expense, since the ambulance transport was deemed medically necessary. Maggie required immediate surgery in Indianapolis to repair a malfunctioning shunt in her skull that was triggering severe headaches and vomiting.

But despite paying all of their health insurance premiums, the family says Anthem agreed to pay only $809 of the ambulance charges – leaving the Kimmels to cover the balance. The family agreed to pay their insurance deductible and co-pay ($951), hoping the insurance company and ambulance company would come to an agreement on the rest. But they did not.

The Kimmels recently received an updated invoice from Superior for $14,059. The bill said their account was past due and would result in collection activity if there was further delay in making payment.

“We’re both educators. We don’t have that kind of extra money,” said Jen Kimmel. “It’s absolutely absurd.”

Nick said repeated attempts to get Anthem to negotiate a settlement with Superior were unsuccessful.

“We went back and forth with them but didn’t really get anywhere. They said your appeal was denied based on the coverage you have,” he told 13News. “They denied us based on their policies.”

The Kimmels’ story is a familiar one for families across Indiana and the nation.

A recent report by the Public Interest Research Group shows ambulances transport over 3 million Americans with private insurance every year, and over half of those patients are exposed to a surprise bill. That surprise comes months later when insurance companies deny coverage because the emergency transport was provided by an out-of-network ambulance, leaving patients stuck paying the balance.

Those types of surprises are not supposed to happen.

Three years ago, Congress passed the No Surprises Act to protect consumers from surprise medical bills. Hospitals, clinics and air ambulances are covered by the law. But ground ambulances were not included in the No Surprises Act, sticking millions of Americans with surprise bills.

13 Investigates highlighted the problem last fall with a three-month investigation. It showed how the lack of settlement negotiations between some insurance companies and ambulance providers results in families facing huge ambulance bills when insurance rejected their claims.

The investigation featured the Thedwall family from Fishers, which received an $8,470 bill for their 1-year-old son’s ambulance transport, and the Trendowski family that got stuck with a $9,076 bill for their daughter to be transported by ambulance from Crown Point to Chicago. Both families have health insurance, but their insurance companies declined to pay the large bills because the transports were provided by an out-of-network ambulance service. (Currently, nearly all ambulance companies are considered out-of-network – something patients rarely think about when they find themselves in an emergency.)

The Thedwalls eventually resolved their invoice by appealing to their insurer with the help of a private service. The Trendowski case dragged out much longer.

Superior Ambulance and Anthem refused to budge on the Trendowskis' $9,076 bill until 13News broadcast their story and sent a request to both companies asking them to negotiate a settlement. They eventually reached an agreement, with Superior settling for a $4,521 payment from Anthem - nearly five times higher than Anthem’s original payment and less than half of Superior’s original charges. The Trendowskis' bill was then considered paid in full, except for the family’s much more affordable deductible.

“After your story, Anthem reached out to us and said we'd like to negotiate on this particular case,” said Superior Ambulance spokeswoman Kim Godden. “They were finally willing to talk with us … and they increased their initial offer because I think they understood the importance of the transport after seeing your story.”

Following the 13News investigation, other Indiana families - like the Kimmels - continued to struggle with surprise ambulance bills, prompting the Indiana General Assembly to take action.

How the law works, who it protects

House Bill 1385 requires insurance companies “to provide payment to a nonparticipating ambulance service provider for ambulance service provided to a covered individual.” The legislation caps the payment amount to the lesser of:

- A rate established by the county or municipality where the service originated

- 400% of Medicare’s ambulance reimbursement rate

- The ambulance provider’s billed charges

The legislation also requires that the payment from the insurance companies “shall be considered payment in full” – except for any copayment, coinsurance, deductible that the health plan requires the patient to pay. It prohibits the ambulance provider from billing the patient for any additional amount, which means families like the Kimmels, Trendowskis and Thedwalls would not be responsible for paying a huge balance not covered by insurance.

The lawmakers who wrote and sponsored the legislation said they supported a new law to help ensure ambulance services would not be forced to close due to insufficient reimbursement, and to prevent insured families from being blindsided by unexpected bills that insurance companies refused to cover.

“It’s just so heartbreaking to see these bills,” said bill co-author Rep. Robin Shackeford, D-Indianapolis. “That’s why we finally stepped in: because when you have one company not willing to negotiate with another company and you’re talking about life threatening services, then we somehow have to come to an agreement.”

“When you have outrageous things happen, we really need to reign it in and set up guard rails so patients are protected,” agreed Sen. Tyler Johnson, who sponsored HB 1385 in the Senate.

The bill received overwhelming bipartisan support in both the House and Senate before Gov. Holcomb signed it into law Wednesday afternoon.

It also received tremendous support from the ambulance industry.

“This bill makes sure EMS receives fair reimbursement and, most importantly, it makes sure patients don’t need to worry about being put the middle when they need an ambulance,” said Godden, the Superior Ambulance spokeswoman who also serves as a board member for the Indiana Emergency Medical Services Association.

IEMSA executive director Gary Miller said the bill will protect both Indiana consumers and ambulance companies.

“It forces the insurance companies to pay at a rate that is reasonable that ambulance companies can live with, and it prevents patients from getting large bills,” Miller told 13News. “We are extremely grateful for that because we did not like seeing families get these bills that were just growing and growing.”

But the Insurance Institute of Indiana says the new law could result in higher insurance premiums for businesses, and those costs might then be passed along to consumers.

“The insurance industry will base premiums based on costs and what’s being collected, so I think insurance rates will go up,” institute president Marty Wood told 13News.

The new law also excludes thousands of Hoosiers from the ambulance billing protections.

Hoosiers who have health insurance through Medicare, Medicaid or Indiana’s insurance plan for state employees are not covered under the new law, although those health plans generally do not result in large balance bills for covered individuals who need an ambulance.

State residents who rely on their employer’s self-funded health plans are also not included in the new state law because such health plans are regulated by federal law. A federal ambulance taskforce is recommending that Congress pass more extensive legislation to ban balance billing for ground ambulance services nationwide.

Despite some concerns, Wood acknowledges Indiana’s new law will significantly help many families that require an ambulance transport.

“The balance billing prohibition is clearly a win for consumers. They’re not going to see that $15,000 bill now, so that’s a positive,” he said.

Still caught in the middle

The new law takes effect Jan. 1, 2025.

In the meantime, families like the Kimmels are still left battling their huge ambulance bills.

“I don’t intend to pay it. I’ll figure out how to fight it,” Jen said, looking at the invoice in her living room.

Nick Kimmel said he and his wife had contacted Superior several times, and the ambulance service indicated that its attempts to reach a settlement with Anthem Blue Cross and Blue Shield yielded no results.

The family’s attempts to appeal their insurance denial with Anthem was also unsuccessful.

“They said, ‘Your appeal was denied based on the coverage that you have,’” Nick said of his discussions with Anthem. “I think they denied us based on their own policies.”

Earlier this month, 13Investigates contacted both Superior Ambulance and Anthem Blue Cross and Blue Shield to request they negotiate a settlement for the Kimmels.

Just a few days after 13News sent that email, Superior said Anthem agreed to begin negotiations for the first time since the Kimmel’s claim had been filed months earlier. Godden said both sides have reached an agreement based upon the terms of the newly-signed law – even though that law will not take effect for nine more months. She said Anthem has agreed to pay a rate equal to 400% of what Medicare allows for the ambulance transport. An Anthem spokesman also confirmed the two sides are actively negotiating a settlement.

“We have been in conversations with Superior to negotiate the amount they charged the Kimmels. Once those details are finalized, we will communicate the specifics directly with the family,” said Anthem spokesman Tony Felts.

The Kimmels say, so far, they have received no additional communication from Anthem. Felts declined to answer questions from 13News about why Anthem denied the family’s appeal and why the insurance company failed to begin settlement negotiations with the ambulance service until it received questions from 13 Investigates.

Anthem also waited months to begin settlement negotiations with Superior for the Trendowski family’s ambulance bill - doing so only after receiving a direct appeal from 13News.

“That’s why we finally stepped in,” Shackelford told 13News. “Because when you have one company not willing to negotiate with another company and you’re talking about life threatening services, then we somehow have to come to an agreement.”

No more surprises?

A federal advisory committee is now working to help prevent ambulance balance billing nationwide.

Just days after 13News aired its original investigation, the Advisory Committee on Ground Ambulance and Patient Billing (GAPB) met in Washington, D.C. The committee approved 21 recommendations related to ambulance billing, and the committee is sending a report to Congress recommending that federal lawmakers adopt its recommendations into law.

Among the recommendations:

- Amend the No Suprises Acts to ban the practice of surprise ambulance billing for consumers.

- Patients should be charged no more than $100 for an ambulance transport with insurance companies paying the rest.

- Ambulance and insurance companies should establish fixed reimbursement rates for ambulance transports that will be more fair and predictable for both parties.

The committee’s extensive list of recommendations to Congress along with its voting summary can be found on the committee webpage.

How to avoid surprise medical bills

Despite new laws meant to protect consumers against many types of surprise bills, medical billing can still be hard to understand and not very transparent. Knowing the resources that are available and the right questions to ask can go a long way in helping to reduce your risk of getting a surprise bill.

Ask the right questions

These three questions will help you determine if you are at risk for a surprise medical bill:

- Is my doctor or medical specialist in-network? (Yes = lower health care costs)

- Will I receive services from anyone else during my procedure who is not in-network? (Yes = higher health care costs)

- Is the facility in-network? (Yes = lower health care costs)

Whenever possible, get the answers to these questions in writing.

It's important to use the term “in-network” when asking these questions. While a doctor or facility might “accept” your insurance, that does not necessarily mean they accept your specific plan.

These questions also need to be asked every time you receive health care. Many plan providers change from one year to the next, and a doctor who might be in-network this year could be out-of-network in a couple of months.

Starting in January 2022, medical providers and facilities were required to notify you of any out-of-network practitioners who will be providing your health care and obtain your permission before they can seek reimbursement for higher out-of-network rates.

Request a good faith estimate

In many situations, state and federal laws require health care providers and facilities to provide a good faith estimate to patients – as long as you request one. In some situations, those good faith estimates are required whether requested or not.

If you are legally entitled to an estimate, ask for one, and do as soon as possible. Make sure to request a good faith estimate at least five business days prior to your procedure (providers do not have to provide an estimate if given less notice) to catch potential surprises before you receive your medical care. Realizing that you may receive services from an out-of-network provider before your procedure gives you an opportunity to reschedule the medical care at a different facility that might not use out-of-network providers, costing you much less.

Use online price tools

Indiana hospitals are now legally required to provide an online list of prices for their most common procedures. Checking those price estimator tools allows patients to shop around for prices, which is especially valuable for those who are uninsured or planning to pay for health care services out of pocket.

The non-binding estimates often include a series of disclaimers, including warnings that estimates may not include out-of-network provider charges and various support services required during procedures. Insured patients may find it more difficult to get an accurate estimate without calling a health care facility directly to provide more detailed insurance information. Nonetheless, the price estimator tools are a positive step towards medical billing transparency.

You can usually find price estimates online by typing the name of a specific hospital network and the term “price estimator” into a search engine.

In an emergency

Air ambulances are covered by the No Surprises Act, but ground ambulances are not. In an emergency, you won’t have time to shop around for an in-network ambulance, and according to Kim Godden of Superior Ambulance Service, nearly 75% of ground ambulance services nationwide are out-of-network anyway.

If you receive an ambulance bill that was denied by your insurance company, appeal the denial with your insurance carrier and, if need be, appeal to the highest level within the company. If the bill is still denied, you can file a complaint and submit an appeal to the Indiana Department of Insurance. Many ambulance companies also offer payment plans and discounts for families who need financial assistance with bills that are not covered by insurance.

Patricia Kelmar of the Public Interest Research Council recommends that consumers who cannot afford their ambulance bill should not pay the invoice with a credit card. She says many states offer consumers greater protections for medical debt than for consumer debt, and once an ambulance bill is switched over to a credit card, it becomes consumer debt.