WASHINGTON — Americans have until Monday, May 17 to file their 2020 income taxes with the Internal Revenue Service.

The IRS delayed the deadline from April 15 to May 17 to allow for more breathing room for taxpayers and the IRS alike to cope with changes brought on by the coronavirus pandemic. If taxpayers are unable to file their taxes by Monday, they can request an extension until October 15.

“The IRS wants to continue to do everything possible to help taxpayers navigate the unusual circumstances related to the pandemic, while also working on important tax administration responsibilities,” IRS Commissioner Chuck Rettig said in a statement in March when the tax filing date was extended.

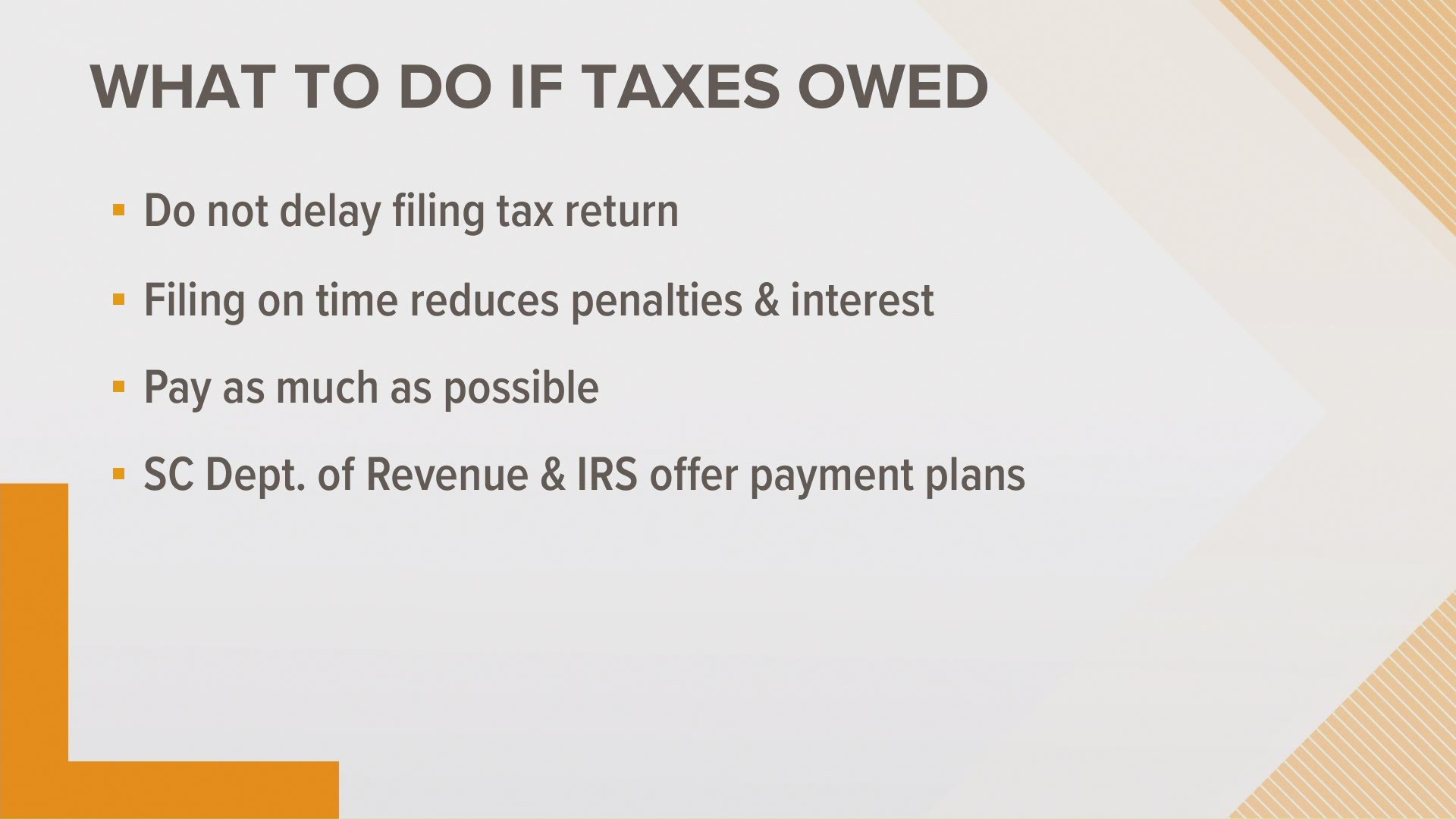

Taxpayers will face penalties and interest if they do not file their taxes by the May 17 deadline.

Need an extension?

The IRS said individual taxpayers who need additional time to file beyond the May 17 deadline can request a filing extension until Oct. 15 by filing Form 4868 through their tax professional, tax software or using the "Free File" tool on the IRS's website.

However, the IRS said that filing the 4868 form gives taxpayers until October 15 to file their 2020 tax return but does not grant an extension of time to pay taxes due. Taxpayers should pay their federal income tax due by May 17, 2021, to avoid interest and penalties.

Why is Tax Day May 17?

In March, the IRS announced that the traditional tax filing deadline will be moved from April 15 to May 17.

The decision to extend the deadline comes after an intense year for the chronically underfunded IRS. The pandemic hit in the middle of last year's tax filing season, setting the agency back in terms of processing. The IRS has also been a key player in doling out government relief payments, and is currently helping to send out the third round of payments in the middle of the current tax filing season.

Additionally, the extension gives the IRS time to issue guidance on recent tax law changes. The American Rescue Plan excludes the first $10,200 of unemployment benefits from federal taxes for those making less than $150,000.

Different tax due date for winter storm victims

Earlier this year, following the disaster declarations issued by the Federal Emergency Management Agency (FEMA), the IRS announced relief for victims of the February winter storms in Texas, Oklahoma and Louisiana.

These states have until June 15, 2021, to file various individual and business tax returns and make tax payments. This extension to May 17 does not affect the June deadline. Click here to learn more about disaster relief from the IRS.

How to file taxes online

The IRS offers a Free File tool for taxpayers to file their tax returns electronically. The IRS Free File offers brand-name tax software for taxpayers with an income of $72,000 or less in 2020. Taxpayers who earned more can use Free File Fillable Forms, the electronic version of IRS paper forms. The tool also lets taxpayers get an automatic extension of time to file if they need it.

The Free File tool is also a way to get a refund fast. Filing electronically and using direct deposit is the fastest and most accurate way to file and get a refund. The IRS issues nine out of 10 refunds in 21 days or less. Taxpayers filing on paper can also choose direct deposit, but paper returns take longer to process.

When should taxpayers expect refunds?

The IRS said it is taking more than 21 days to issue refunds for some 2020 tax returns that require review including incorrect Recovery Rebate Credit amounts, or that used 2019 income to figure the Earned Income Tax Credit (EITC) and Additional Child Tax Credit (ACTC).

Some tax returns take longer to process than others for many reasons, including when a return:

- Includes errors

- Is incomplete

- Is affected by identity theft or fraud

- Includes a claim filed for an Earned Income Tax Credit or an Additional Child Tax Credit. See Q&A below.

- Includes a Form 8379, Injured Spouse Allocation PDF, which could take up to 14 weeks to process

- Needs further review in general

Americans can check the status of their refund here through the Where's My Refund tool.

Contribution to IRA, Health Savings Account deadline

In extending the deadline to file Form 1040 series returns to May 17, the IRS automatically postponed the date for individuals to make 2020 contributions to their individual retirement arrangements (IRAs and Roth IRAs), health savings accounts (HSAs), Archer Medical Savings Accounts (Archer MSAs), and Coverdell education savings accounts (Coverdell ESAs).

All contributions are due by May 17.

2017 unclaimed refunds – deadline extended to May 17

For the tax year 2017 Federal income tax returns, the normal April 15 deadline to claim a refund has also been extended to May 17, 2021. The law provides a three-year window of opportunity to claim a refund. If taxpayers do not file a return within three years, the money becomes property of the U.S. Treasury.

The law requires taxpayers to properly address, mail and ensure the tax return is postmarked by the May 17, 2021, date. Additionally, foreign trusts and estates with federal income tax filing or payment obligations, who file Form 1040-NR, now have until May 17, 2021.

Need more tax help?

Taxpayers can find answers to questions, forms and instructions and helpful tax tools at IRS.gov.

The Associated Press contributed to this report.