INDIANAPOLIS — Robb Fine and Harold Wilson have never met, but they have a lot in common.

Both men own small businesses in Indianapolis. Both work long hours to make their companies successful. And both have lost thousands of dollars due to recent check fraud.

“They’re stealing the checks right out of the mailbox,” Wilson said. ”It’s a big deal. The first four checks they stole are about $12,000.”

“We lost $21,000,” Fine told 13News. “And how they’re doing it is just so easy. Somebody’s got to stop it.”

Fine and Wilson are not just angry with the thieves. They say they are also frustrated with their banks for allowing the fraud to happen. And they are not alone.

A 13News investigation found check fraud is surging nationwide as criminals use new technology to commit an old crime that now costs Americans more than a billion dollars each year.

“Absurd that the bank accepted that check”

Robb Fine and his wife own a promotional products distribution company on the northwest side of Indianapolis. They take pride in paying their vendors quickly. But in January, the Fines started hearing from some of those vendors who had not received timely payments.

“They said they hadn’t received the checks we sent, so we put a stop payment on them and re-issued new ones right away,” Fine explained. “Then, we come to find out the original checks had already been cashed. They were stolen and altered and cashed by someone else. And they’re so blatant, it’s ridiculous.”

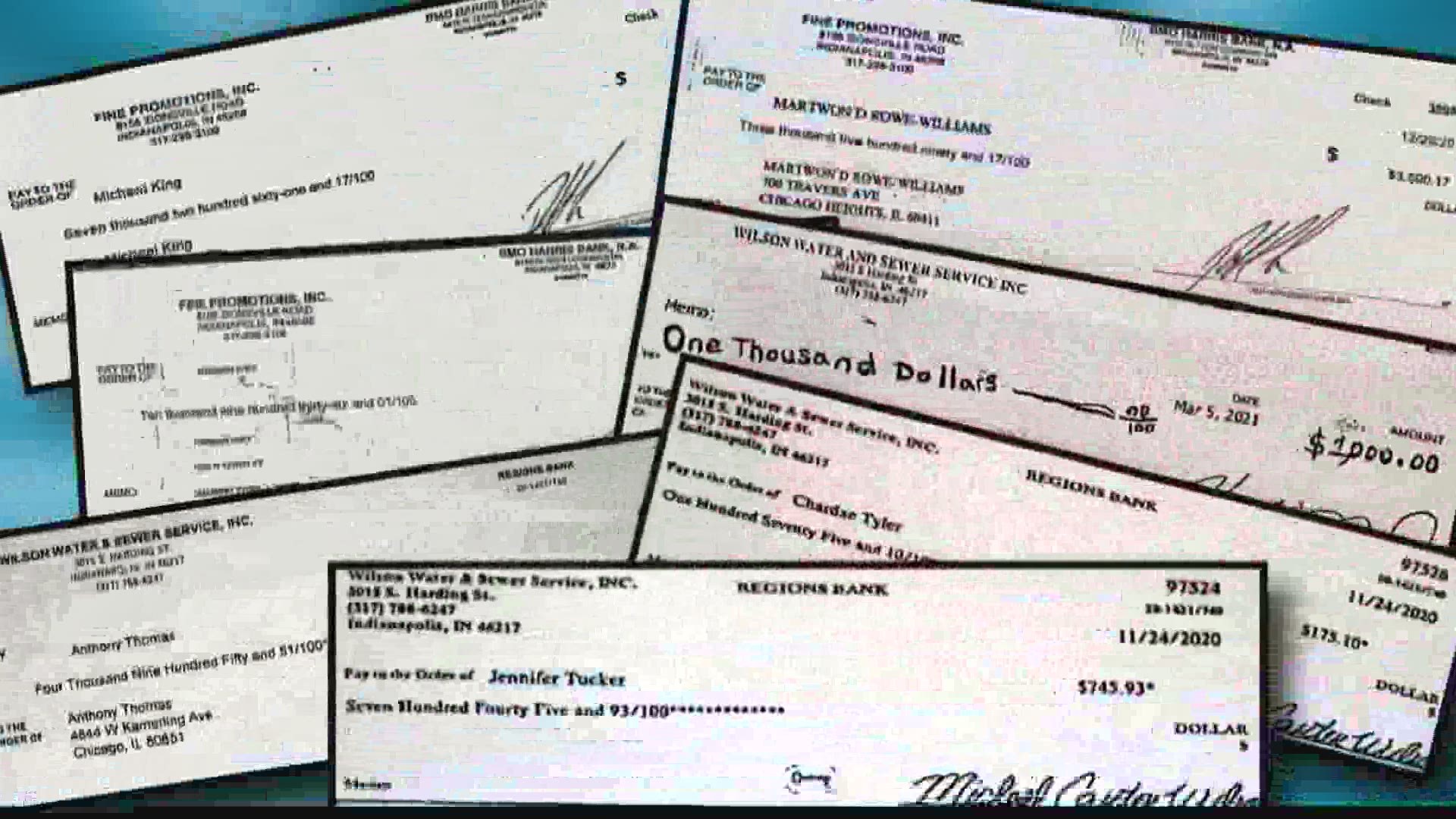

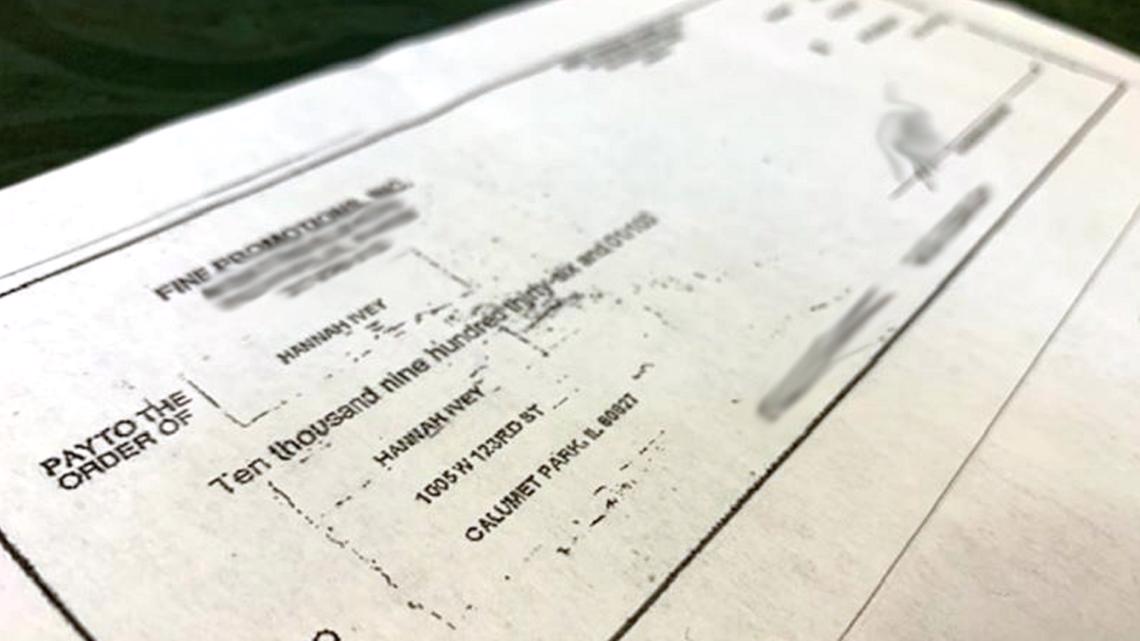

After the checks were mailed, someone manipulated them to change the names and addresses of the payees. The typed names of vendors were altered so the checks were instead payable to Michael King, Martwon Rowe-Williams and Hannah Ivey.

Who are those people?

“I have no idea how to answer that question,” Fine said. “Never heard of them before.”

The type font used to alter the information on the checks is clearly different than the type used on the rest of each document. And one of the photocopied checks shows the name and address of the original payee were sloppily covered by strips of paper that the perpetrator cut and pasted onto the altered document. As far as con-jobs go, this wasn’t even a good one.

“That looks absolutely ridiculous. The whole thing just screams fraud,” Fine said, pointing to the altered check and shaking his head in disgust. “It was absurd that the bank accepted that check and allowed that to happen.”

Targeted at work and at home

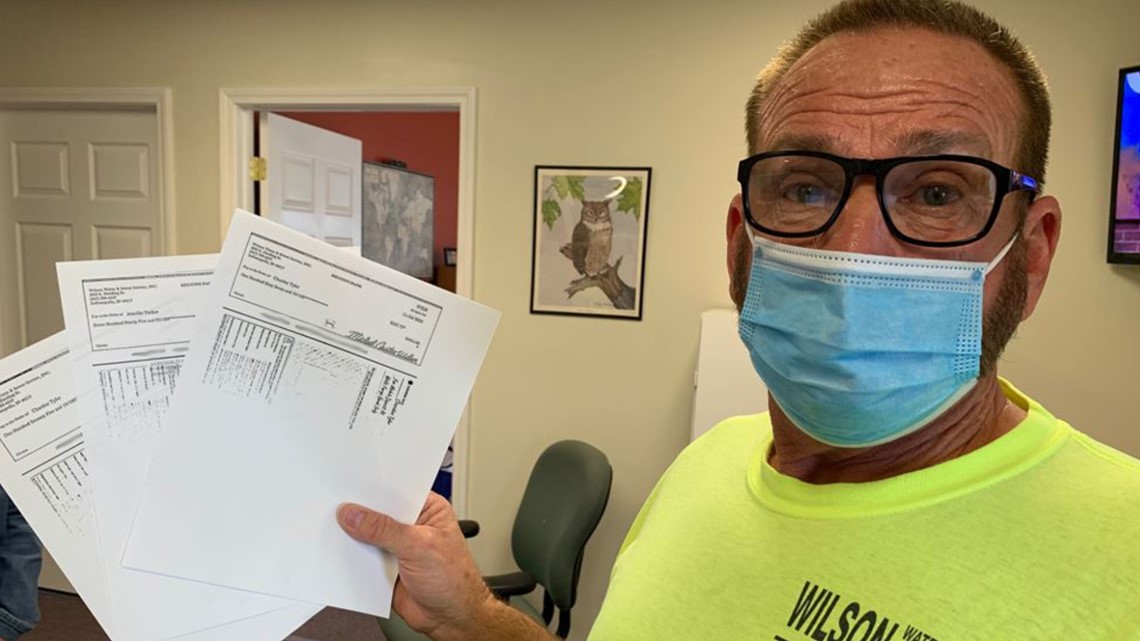

The checks stolen from Wilson’s plumbing and sewer service were manipulated even more.

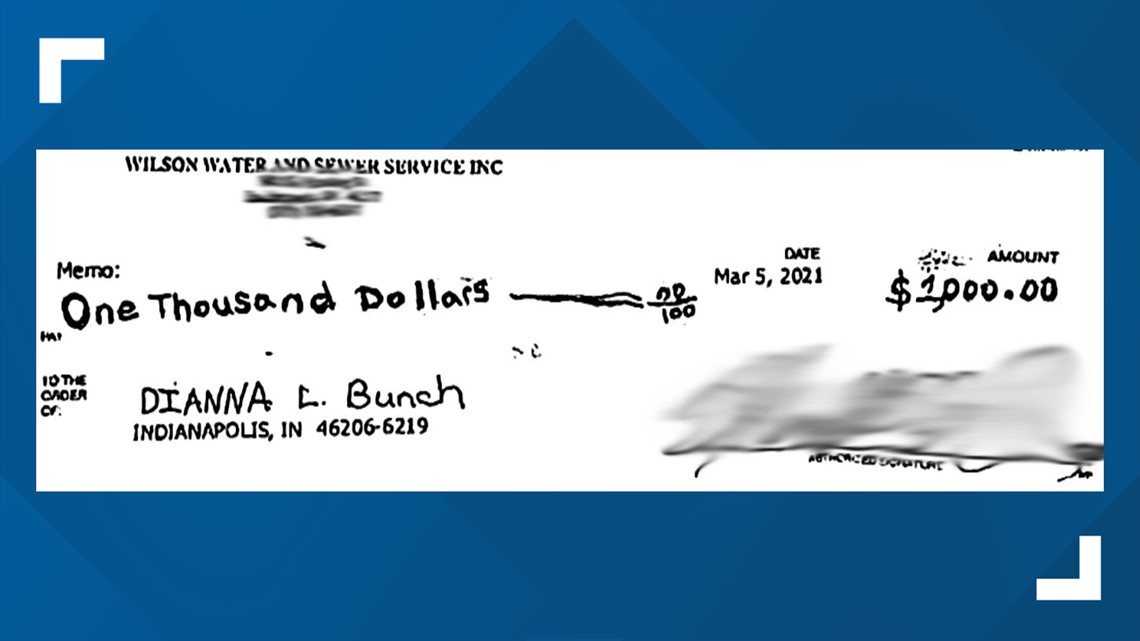

Whoever stole the checks from the company’s south side mailbox used the information on the documents to create entirely new checks. They re-typed all of the business information – name, address, account number and bank routing number – onto new documents. The thief then changed the payee name on each check and the amount of each payment.

“The amounts are whatever they thought they could get out of our account,” said Donna Shepler, Wilson’s office manager. “We didn’t even sign those altered checks. They put in their own names and signed four different checks with four different names and signatures. And the bank still took them.”

The first checks taken from Wilson Water & Sewer Service were stolen and cashed last August. Thieves tried to do the same thing again in November, but they were unsuccessful because the company’s compromised checking account had already been closed.

And just a few weeks ago, Wilson and his family were hit by check fraud again. His wife, Mary, says a $63 check was stolen out of their home mailbox on a Friday afternoon. By Monday, it had been altered and cashed by a stranger for $1,000.

A copy of the stolen check shows a substance was used to cover over the payee name and dollar amount, which had both been printed by a computer. A new name and amount were then handwritten onto the check, which was cashed by the Wilsons’ bank.

Why would a bank accept a check with very obvious warning signs of fraud?

“Because it went through the mobile banking,” said Mary, standing next to the mailbox where her most recent check was stolen. “Some of the new technology is allowing people to get away with this.”

“No question, what makes it easy to happen is the online app the bank gives you,” added Fine. “It’s a total mess and without that, people do not get away with this crime so easily.”

Surprisingly easy

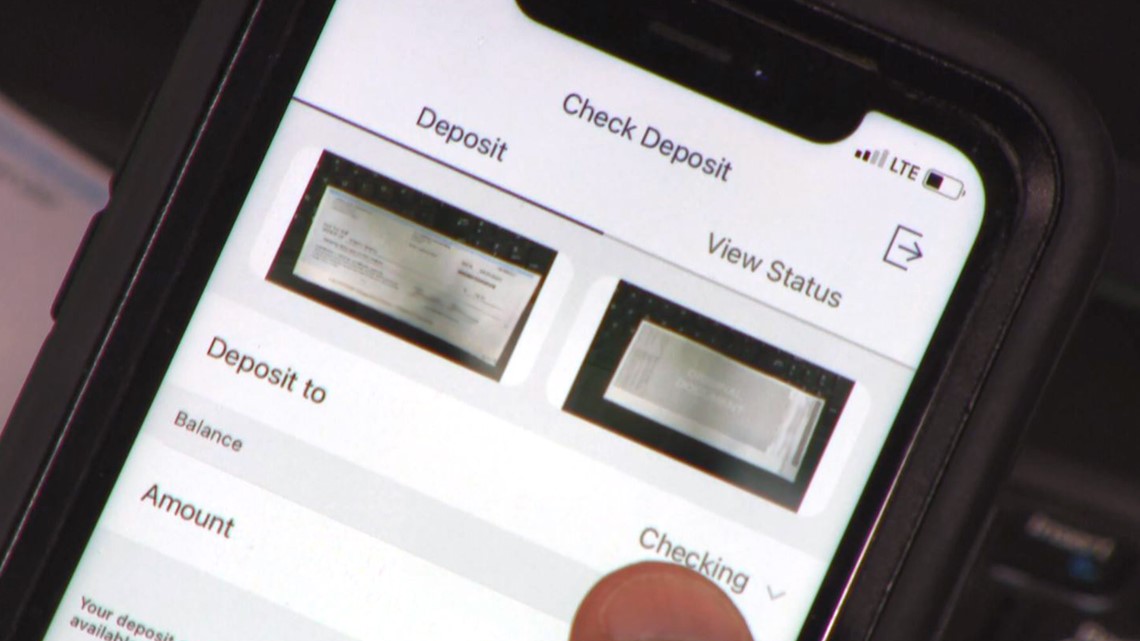

The Fines and Wilsons are talking about those handy banking apps that millions of people now use to deposit checks.

Known as mobile banking, the apps offer speed and convenience that eliminate the need for many consumers to visit an actual bank or ATM. Want to deposit a check? Simply use a mobile banking app to take a picture of it with your smartphone and you’re done.

Depositing checks through mobile banking has steadily grown in popularity over the past decade, and when COVID-19 dramatically impacted consumers ability to conduct in-person banking in 2020, mobile banking became a necessity.

Last April alone, soon after the pandemic started, new mobile banking registrations jumped 200 percent, according to Fidelity National Information Services which works with dozens of the world’s largest banks. Mobile banking traffic rose 85 percent just a few months into the pandemic and, with millions of new users, has not slowed since.

But consumers aren’t the only ones who enjoy the convenience of depositing checks by phone from the privacy of their own home. Criminals seem to love it too.

“The fraudsters are always one step ahead, and they’ve figured out how to make a deposit and quickly go withdraw the money,” said John Ravita, marketing director for SQN Banking Systems, a company that creates and markets fraud prevention tools for the banking industry. “Check fraud is not that difficult – it’s actually surprisingly easy – and using mobile banking as a channel does make it easier to get away with.”

Ravita believes online banking is ideal for criminals because they never have to show up at a bank or an ATM. Video monitoring systems record fraudulent transactions and bank tellers are trained to ask questions and spot bogus checks.

“I think the challenge with mobile banking is it's faceless, so it is easier for a fraudster to perpetrate fraud,” Ravita told 13News. “They are getting smart, and they know how to increase their odds of avoiding detection.”

How banks are responding

Bad checks account for the largest financial losses banks face due to deposit fraud. In 2018, even before the spike in mobile banking, criminals stole $1.3 billion through check fraud, according to the American Bankers Association. But that same year, the organization reports banks stopped 10 times that amount in attempted check fraud – $13.8 billion – thanks to anti-fraud technology.

“Protecting customers from fraud is a top priority for the nation's banks. Banks of all sizes use a range of sophisticated systems to prevent the overwhelming majority of fraud attempts, including check fraud,” ABA spokesman Jeff Sigmund told 13News.

The sophisticated systems include software that banks can purchase to review checks for signs of fraud. SQN Banking Systems, for example, offers an automated fraud program that reviews 15 separate points of potential fraud on each check before it is accepted. Checks that fail the review are then flagged for further scrutiny. SQN says the software thoroughly reviews more checks for potential fraud in a few minutes than a bank employee could review in an entire day, saving financial institutions time and money.

“Rather than having 10 employees looking at 1,000 checks or 10,000 checks, the software is going to do that for them and can look for a lot more than the human eye will normally recognize. It definitely drives down the amount of fraud,” said Ravita. “I do want to give financial institutions credit: they’re doing a heck of a job stopping check fraud as best they can.”

Some of the available anti-fraud technology that banks utilize focuses primarily on signatures. Other software analyzes transactional data or geodata and conducts behavioral analysis to help catch potential signs of fraud and unusual activity involving a specific checking account.

Banks and software companies are careful not to share too much information about how their anti-fraud systems work, but they say the systems are very effective.

“The technology is definitely there, and there are solutions available that can pick up on inconsistencies with checks and mobile banking. They do work,” said Suzanne Sando, a senior fraud management analyst at Javelin Strategy & Research, which provides advisory services for the banking industry.

Why banks still overlook “outlandish” fraud

But if banks have the technology to spot fraudulent checks deposited by mobile banking, why do they still cash blatantly fraudulent checks like the ones recently stolen from Fine and Wilson?

13 Investigates shared copies of those checks with Sando, and she gasped when she saw them.

“Wow. Just blows my mind. It’s so clearly fraudulent that it borders on outlandish, and it really is a shame those checks get through because maintaining customer trust is so important to a business’ reputation,” she said. “Customers have a right to think ‘Why is that not as secure as it should be?’ There should be more security. The technology is there. It just depends on the financial institution and whether they want to deploy it.”

Sando pointed out there is no requirement that banks use available anti-fraud technology to detect mobile check fraud, and she said many smaller banks and local credit unions do not utilize the tools available to them.

Ravita agreed and said banks can do more to protect their customers from fraud involving mobile banking.

“Most community banks and community financial institutions are still processing their counterfeit and forgery reviews in a manual environment and have not invested enough in technology,” he said.

And even large banks that do use anti-fraud technology often set dollar limits, deploying software analysis only for mobile deposits that involve larger amounts that exceed the limit. The vast majority of banks do not inspect every single check for signs of fraud.

“It’s just not cost-justified to look at every check,” Ravita explained. “How much do I want to invest in technology and how many full-time employees do I want to hire to stop fraud and save dollars? That’s a question each financial institution has to answer.”

Making that investment more of a challenge for the banking industry is the fact that customers are writing far fewer checks than they used to. From 2003 to 2018, Ravita says check usage dropped more than 50 percent thanks to direct deposit and mobile person-to-person money transfer options such as PayPal, Venmo and Zelle. During that same time period, the amount of check fraud attempts doubled, despite a significant increase in the number of checks written.

“The reality is, for financial institutions, checks aren’t sexy. Debit cards, person-to-person payment, everything else is where the [anti-fraud] investment is going,” Ravita told 13News.

“Checks are definitely declining, but they are not going away anytime soon,” Sando said. “So with mobile banking … financial institutions should have security solutions to detect fraud. It really shouldn’t be ignored.”

RELATED: IRS bringing deceased Indiana man back to life, other 'dead' taxpayers still waiting their turn

Waiting for justice – and their money

The ABA declined WTHR’s request for an interview to discuss mobile banking fraud, but the trade organization did send an email highlighting the industry’s success in tackling the problem. It says anti-fraud efforts by financial institutions stop 90 percent of fraud attempts by using “specific procedures and technologies to detect and counter check fraud, including artificial intelligence, deposit reviews and holds, teller training and customer education."

And when those procedures and technology do not prevent fraud, the ABA says consumers are usually reimbursed.

“When fraud does occur, customers are typically made whole, depending on the individual circumstances,” Sigmund wrote.

But that doesn’t always happen, and when it does, it can often take a very long time.

Wilson says he is still waiting to be made whole.

His bank recently refunded two of the checks stolen from his business and the one stolen from his home mailbox. But more than nine months after the first checks were altered and cashed, Wilson is still waiting to be reimbursed for two of the fraudulent checks that total nearly $3,000.

“They said we allowed it to happen. That just isn’t true, so we’re fighting that point,” his office manager said.

Fine’s bank has reimbursed him for only half of his losses. He’s still missing about $11,000 due to fraudulent checks cashed through mobile banking.

“Nobody’s jumping up and down and saying we’re going to take care of this,” he said. “I don’t think anybody realizes how disruptive and costly this is for a business. And my bank told me they have six other cases right now with other people going through the same thing.”

Both businessmen have filed police reports, but so far, investigators have not made any arrests. Criminals know that check fraud often does not get high priority in communities where police departments are busy investigating a high number of violent crimes.

Fine and Wilson are now trying to warn others about mobile banking fraud, and they hope banks will take additional steps to make the technology more secure.

“They’ve got to stop this problem. Those apps are just a nightmare that make this way too easy,” Fine said.

“It’s unreal that the world’s gotten like this where you can’t use your own mailbox,” added Mary Wilson. “People are getting away with this, and it doesn’t seem like anyone’s having to pay for what they’re doing.”

How to protect yourself

Criminals can create a fake check and target your bank account simply by getting your personal information or by getting ahold of one of your checks. The American Bankers Association offers the following advice to help reduce your risk of being a victim of mobile check fraud:

- Don’t share your information.

Don’t provide your Social Security number or account information to anyone who contacts you online or over the phone. Protect your PINs and passwords and do not share them with anyone. Use a combination of letters and numbers for your passwords and change them periodically. Do not reveal sensitive or personal information on social networking sites. - Shred sensitive papers.

Shred receipts, banks statements and unused credit card offers before throwing them away. - Monitor your accounts regularly.

Rather than waiting for your monthly statement, use online banking to monitor transactions on your account regularly. If you see a fraudulent transaction, notify your bank immediately. - Sign up for text alerts.

Sign up for text or email alerts from your bank for certain types of transactions, such as online purchases or transactions of more than $500. - Protect your mobile device.

Use the passcode lock on your smartphone and other devices. This will make it more difficult for thieves to access your information if your device is lost or stolen. Before you donate, sell or trade your mobile device, be sure to wipe it using specialized software or using the manufacturer’s recommended technique. Some software allows you to wipe your device remotely if it is lost or stolen. Use caution when downloading apps, as they may contain malware, and avoid opening links and attachments – especially from senders you don’t know. - Keep tabs on your mail.

Fraudsters look for monthly bank or credit card statements or other mail containing your financial information. Consider enrolling in online banking to reduce the likelihood of paper statements being stolen. Also, don’t mail bills from your own mailbox with the flag up. - Monitor your credit report.

Order a free copy of your credit report every four months from one of the three credit reporting agencies at annualcreditreport.com. - Protect your computer.

Make sure the virus protection software on your computer is active and up to date. When conducting business online, make sure your browser’s padlock or key icon is active. Also look for an “s” after the “http” to be sure the website is secure. - Enable Multi-Factor Authentication.

In addition to guarding sensitive financial information, we highly recommend consumers enable multi-factor authentication as one of the highest levels of protection against their account being hacked. - Report any suspected fraud to your bank immediately.